The Leelanau County Board of Commissioners approved the apportionment report for 2024, which is an analysis and listing of the millage rates levied in the county, at their regular session Tuesday.

Andrew Giguere, the county’s equalization director, presented the report to the board at their Oct. 1 executive session. Giguere explained that “equalization” itself means ensuring that all property is being assessed fairly and uniformly. After equalization in May, the county must complete apportionment at their annual meeting in October.

“The board of commissioners exercises oversight on how the overall taxable value of the county, and the revenue generated by that taxable value, is distributed across the various governmental units within the county,” Giguere said.

According to the apportionment report, the July 1 operating millage levy of 3.3083 mills should have brought in over $13 million, not accounting for delinquent taxes, late payment fees, and other factors. The county’s total taxable value is just under $3.95 billion, which is a 9.3% increase from $3.6 billion last year. One mill equals a thousandth of the total taxable value, or about $3.95 million.

Giguerre said that the county’s taxable value was just $900 million in 1994, so the land value increased by 325% over 30 years. For many, the most direct evidence of this change is the everrising home prices. In August, the average sale price for a home in the county exceeded $1 million for the first time.

“The average sale price for a house in Leelanau County is something like a million dollars. That’s part of that is why our taxable values are so high. If you want to know taxable values are so high, look for those articles about sale prices, and look for articles about permits. Because that’s the way that those taxable values increase – through sales and through construction,” Giguere said.

The three county-wide millages approved by voters in the Aug. 6 primaries will raise about $4 million this year. The roads and highways maintenance and repair millage is expected to raise over $1.8 million, the senior services millage is raising over $1.1 million, and the early childhood millage could collect slightly under $800,000, according to executive documents from the board’s September regular session.

The apportionment report also estimates local tax dollars by township and village. Currently, the townships that pay the most taxes are Leland at over $2.4 million, Glen Arbor at just under $1.9 million, and Elmwood and Empire are both around $1.45 million. However, Leelanau Township’s taxes are deceptively low. Bingham Township’s taxes are lowest at approximately $65,000.

Giguere said that Leelanau Township residents will vote to renew two millages on the Nov. 5 general election ballot. They are the fire protection and emergency medical services and the township general fund millages. If these millages are approved, they will be levied for four years including 2024.

Giguere said the board will add the millages to the apportionment report after the November elections. If approved, they are estimated to raise over $1.8 million and $275,000 in their first years, respectively. Without these millages, Leelanau Township’s estimated local tax dollars are just under $750,000.

The Suttons Bay-Bingham Fire Authority brings in an estimated $2.1 million. The library millages produce an estimated $300,000 for the Glen Lake Community Library, $325,000 for the Suttons Bay-Bingham District Library, and $75,000 for the Traverse Area District Library. The Bay Area Transportation Authority millage raised an estimated $1.8 million this year.

The estimated local K-12 school tax dollars are about $11.5 million for the Glen Lake Community School District, $8 million for the Leland Public School District, $5 million for the Northport Public School District, $6 million for the Suttons Bay Public School District, and $5 million for the Traverse City School District.

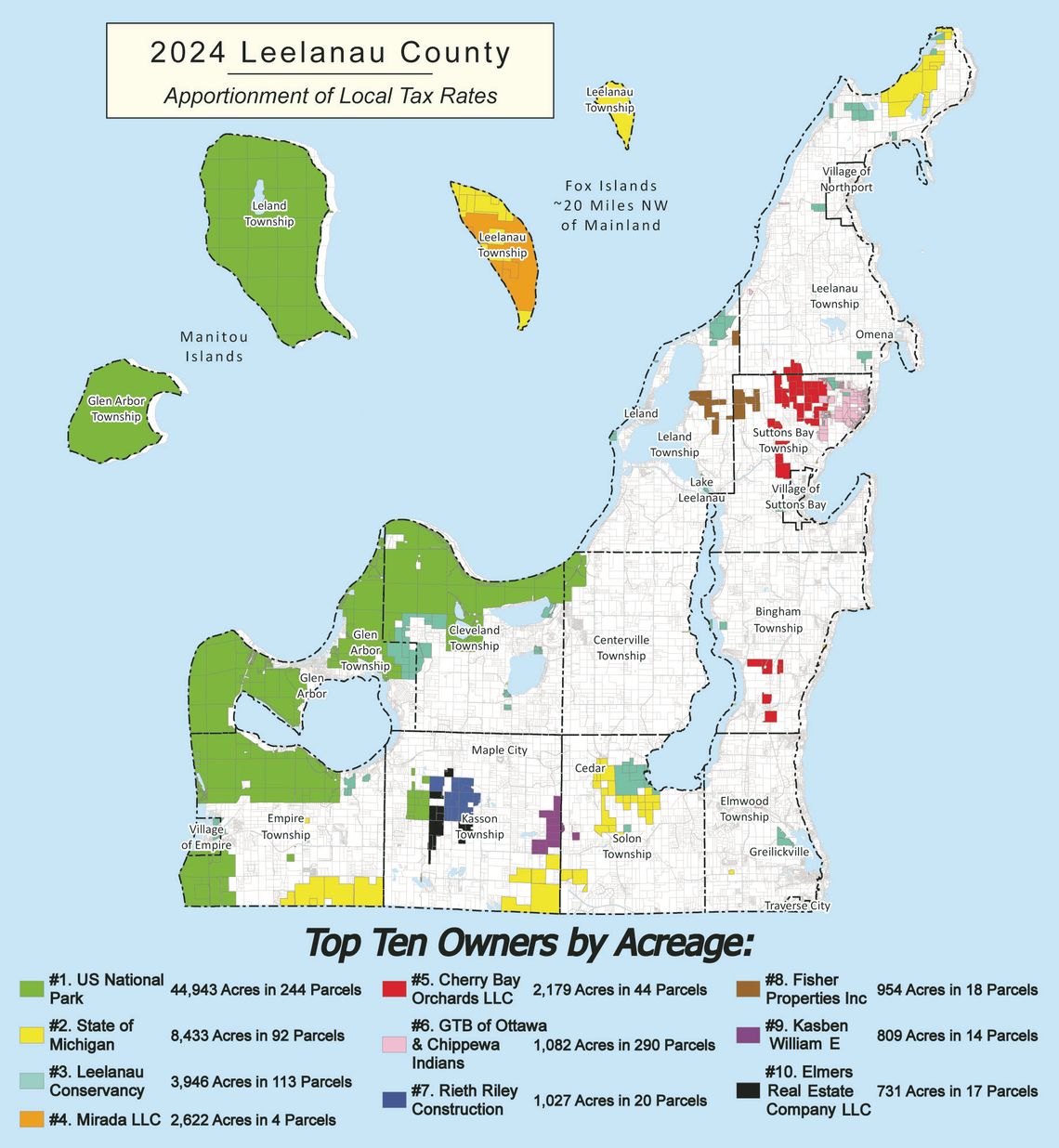

The report also includes lists of the top ten landowners by acreage and by taxable value. Some of the largest landowners are exempt from paying property taxes – including the largest single landowner, the U.S. National Park Service (NPS), which owns and maintains the Sleeping Bear Dunes National Lakeshore and the Manitou Islands.

NPS owns a total of 44,943 acres across 244 parcels. The second top landowner is the state, which holds 8,433 acres across 92 parcels, and is also tax exempt.

The Leelanau Conservancy is the third largest landowner, at 3,946 acres across 113 parcels. Leelanau Conservancy Communications Director Claire Wood said conservancyowned land is tax exempt as well. This also means tax dollars cannot be used for its maintenance and management.

The other top landowners in order of size are Miranda, which owns a large amount of South Fox Island; Cherry Bay Orchards in Suttons Bay; the Grand Traverse Band of Ottawa & Chippewa Indians; Rieth Riley Construction in Kasson Township; Fisher Properties in Leland and Suttons Bay townships; Kasben William, a private landowner; and Elmers Real Estate in Kasson.

About 2.49% of the county’s total taxable value – just under $100 million – comes from just 10 landowners. Consumers Energy is the biggest individual taxpayer and represents 0.74% of the total with over $29 million in taxable value. After Consumers Energy, the top taxpayer is DTE Gas Company at roughly $16,750,000.

The third top taxpayer is MF Developer, a real estate company that owns the Legends Morgan Farms apartments in Elmwood Township, which have a taxable value over $10 million. The other top taxpayers in order areBayberryGroup,Cherryland Rural Electric, Glen Arbor Property, Toms Food Market, Celebrate Life Trust, Cherry Bay Orchards, and Cedar Creek Commons.